It can be overwhelming navigating health insurance plans and terms, but it is important to understand so you can choose the best plan for you and your loved ones. This section is here to help!

This section of First Step covers:

Public versus Private Health Insurance

Public versus Private Health Insurance

Health insurance can be public through the state or federal government. Or it can be private, which means you purchase coverage directly through an exchange or insurer, or you have employer offered coverage.

Public Insurance

Public health insurance is run by your state and/or federal government. These options aren’t available to everyone. You must meet different requirements. Public insurance options include Medicaid, Children’s Health Insurance Program (CHIP), Medicare, and military access.

Each state runs their own Medicaid program. While the programs may differ, to receive federal funding, states must cover certain groups:

- Children up to 18 year old in families with income below 138% of the federal poverty limit (FPL). The FPL changes each year.

- People pregnant and with income below 138% FPL

- Certain parents or caregivers with very low income

- Most seniors and people with disabilities, who receive cash assistance through the Supplemental Security Income (SSI) program

In some states the Medicaid programs directly cover your healthcare. In other states, they use private insurance companies to cover your care.

If you want more information about Medicaid, please go to Healthcare.gov.

CHIP gives health coverage to children up to age 19 through Medicaid and/or a separate CHIP program. This program is good for kids whose families have too high of income to qualify for Medicaid but too low to afford private insurance. In some states, pregnant women qualify as well. While many healthcare costs are free in this program, there may still be some costs families have to pay. These costs can vary by state. If you want more information about CHIP, please go to Healthcare.gov.

Medicare is a federal health insurance program for people who are 65 or older and qualified younger people with specific disabilities. You must be a US citizen living in the US for five consecutive years to receive Medicare. There are different parts to Medicare and additional coverage that can be added. If you want more information about this insurance, please go to Medicare.gov.

The federal government offers two different programs for those who meet the requirements based on their military service: TRICARE and Veteran’s Affairs. Coverage may include insurance for spouses and children as well. If you want more information about these insurances, please go to TRICARE or Veteran’s Affairs Health Benefits.

If you want more information about types of Public Insurance please go to NBDF’s Choosing an Insurance Plan.

Private Insurance

Private insurance refers to health insurance your employer offers as a benefit, or that you purchase in or outside an insurance marketplace.

One of the most common ways to get health insurance in the United States is through your job. Many employers offer health insurance as a benefit. Coverage includes the employee, and in some cases, their families. It may depend on you working full-time or part-time. Usually, the employer covers a portion of the costs of the insurance and the employee covers the rest. The cost of the insurance is called a “premium.” It is the monthly or annual payment to the insurer to get coverage.

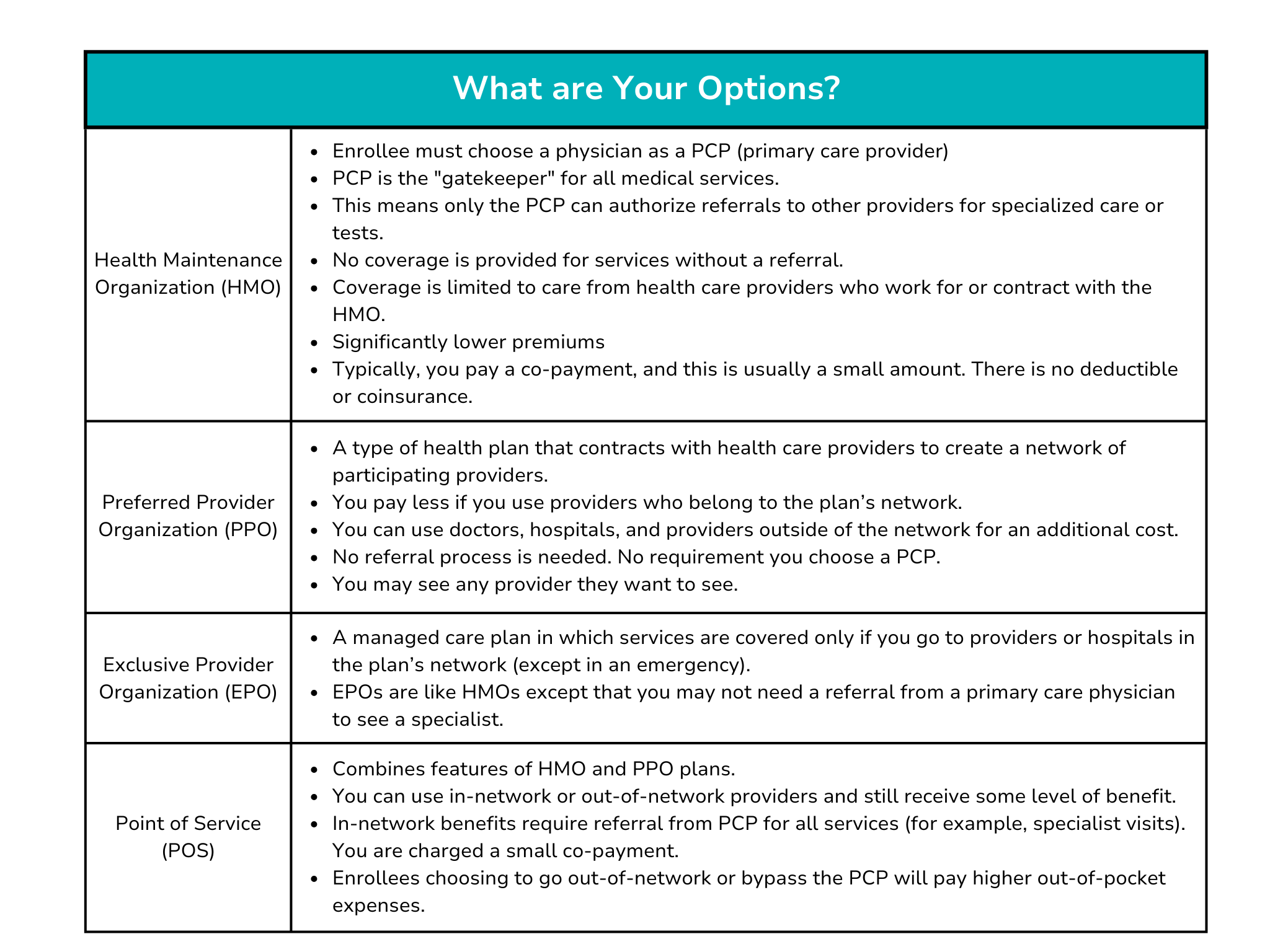

Employees may be offered one or more types of plans to choose from. Types of plans usually include HMOs, PPOs, EPOs, and others. It is important to research what those options mean for you and if they fit your family’s health insurance needs.

Bring your health insurance benefits package to your Hemophilia Treatment Center (HTC) for a social worker or other staff member to review. The HTC will help you understand what is being offered. They can also tell you if you need more information to assure your child’s specific needs for their blood or bleeding disorder are covered.

You can also explore other health insurance options like Medicaid or a Marketplace plan. However, your employer won’t contribute to your premium if you don’t go with their plan.

It is important to find out if your employer plan is fully insured or self-insured.

- Fully insured: Your employer contracts with another organization, such as an insurance company. This organization assumes financial responsibility for employees' medical claims and any administrative costs.

- Self-insured: Your employer itself collects premiums and takes on the responsibility of paying employees’ medical claims. Self-insured plans are not required to follow all parts of the Affordable Care Act. Make sure you understand what your employer is offering and that your child’s medical and treatment needs will be covered.

If you don’t have coverage through your job and don’t qualify for public insurance, you can get insurance coverage in a marketplace. A marketplace is where you can research and purchase a comprehensive health insurance plan. You may also hear them called healthcare insurance exchanges. Some states run their own marketplace, but most are part of the federal government’s Health Insurance Marketplace®.

There are many different plan types like PPO, POS, and others.

To purchase health insurance through the marketplace you must:

- Live in the state in which you are applying

- Be a U.S. citizen (or are lawfully present)

- be not currently incarcerated.

You may be eligible for tax credits or cost-sharing reductions to help make your marketplace plan more affordable.

There are specific times of the year you can purchase a plan. This is called the open enrollment period. If you need to purchase a plan outside of the window due to a life changing event you may qualify for a special enrollment period.

It is also possible to purchase a health insurance plan outside of a marketplace, through an insurance broker. Brokers often share plans that are the same as in the marketplace. If you purchase outside the marketplace, you may not be eligible for tax credits and cost-sharing. These help the marketplace plans to be more affordable. Make sure to do your research.

Choosing the right plan for you and your family is incredibly important. Always do research, ask questions, and seek out support if needed. A resource to help you is NBDF’s Health Insurance Toolkit.

Types of Insurance Plans

Once you know if you will get public or private insurance, then you will need to research the different types of plans. It is important to understand what each plan covers and doesn’t cover, as well as additional out of pocket costs.

Here are some common types of insurance options:

Be careful with High-Deductible Health Plan (HDHP). With these types of insurances, the monthly cost is lower. This can often seem appealing. But these plans can have a high deductible, which is the money you must pay before your insurance covers any costs. Especially if you or your child have expensive medications, such as those treating blood or bleeding disorders, this can lead to very high costs.

Carefully review the insurance options available to you. Make sure you understand what it covers and the expenses you will be responsible for.

Health Insurance Check List

Here are some questions to ask about health insurance plans:

- What type of plan is it (HMO, EPO, PPO, etc)?

- What is the monthly/annual premium for the plan?

- What is the total of my out-of-pocket costs, including medical and prescription co-pays, deductibles, and coinsurance? Visit Insurance Basics for definitions.

- Does the policy cover prescription drugs? If so, is this through a separate drug provider?

- How does the policy cover my bleeding disorder treatment product(s)? Do I have a choice of more than one specialty pharmacy provider?

- Do manufacturer copay cards count towards my deductible or out-of-pocket?

- Does the plan accept third (3rd) party premium assistance?

- Does the policy cover home care services?

- Does the policy provide coverage in the event of catastrophic illness?

- If so, is it enough?

- Would you have to see only those providers in the plan's network?

- If not, what is involved in going out-of-network? Is there the possibility of negotiating with the insurer to cover an annual Hemophilia Treatment Center (HTC) visit under an in-network cost (even if the facility is out-of-network). You can ask if this is possible based on the statistics of how much better people do when seen by an HTC.

- What would your co-pay be for?

- Office visits

- Prescriptions

- Emergency room visits

- Hospital care

- Laboratory services

- Physical therapy

- Mental health services

- Long term care

- Supplies (called durable goods)

- If my employer changes insurance carriers, will my benefits change?

- If so, will anything be different under the new coverage? How?

- Will the policy cover medical services provided in other states?

- Does the policy restrict the delivery of medical services to certain types of health care facility providers, like in-network vs out-of-network?

- Does the policy require prior authorization for coverage of medical services or procedures? Is it required for services by in-network providers or out-of-network providers?

Here are helpful worksheets and guides: