Living with a bleeding or blood disorder can be challenging in many ways for young adults, including understanding insurance. It can be hard to work with your parent or caregiver on choosing the right insurance plan or navigate the health care system. As an affected young adult, it’s important to begin to understand the basics of managing your insurance coverage so you can navigate health insurance as you age out of your parent or caregiver’s coverage. In addition, understanding insurance will allow you to have access to the best possible care.

This section of Step Up covers:

Insurance Overview

Health insurance is a system that helps people pay for their medical expenses. It typically provides protection against unexpected medical expenses that can be very expensive. Health insurance is recommended for everyone and in various states mandatory. Many states continue to enforce a tax penalty for those individuals who do not have health insurance.

Having health insurance is important because it can help you avoid financial problems if you have unexpected medical expenses. It ensures that you will receive the medical care you need without having to worry about how to pay for it. Health insurance can help with high medical bills and preventative care.

It started in the United States in the early 1900s when workers began to ask for protection against work-related injuries. Health insurance became more common after World War II when employers started to offer health coverage as a benefit to their workers1.

People with blood and bleeding disorders may find coverage for their health care and medications through private or public insurance programs. To learn more about the different types of insurance please go to Health Insurance: Options and Types.

Key Terms

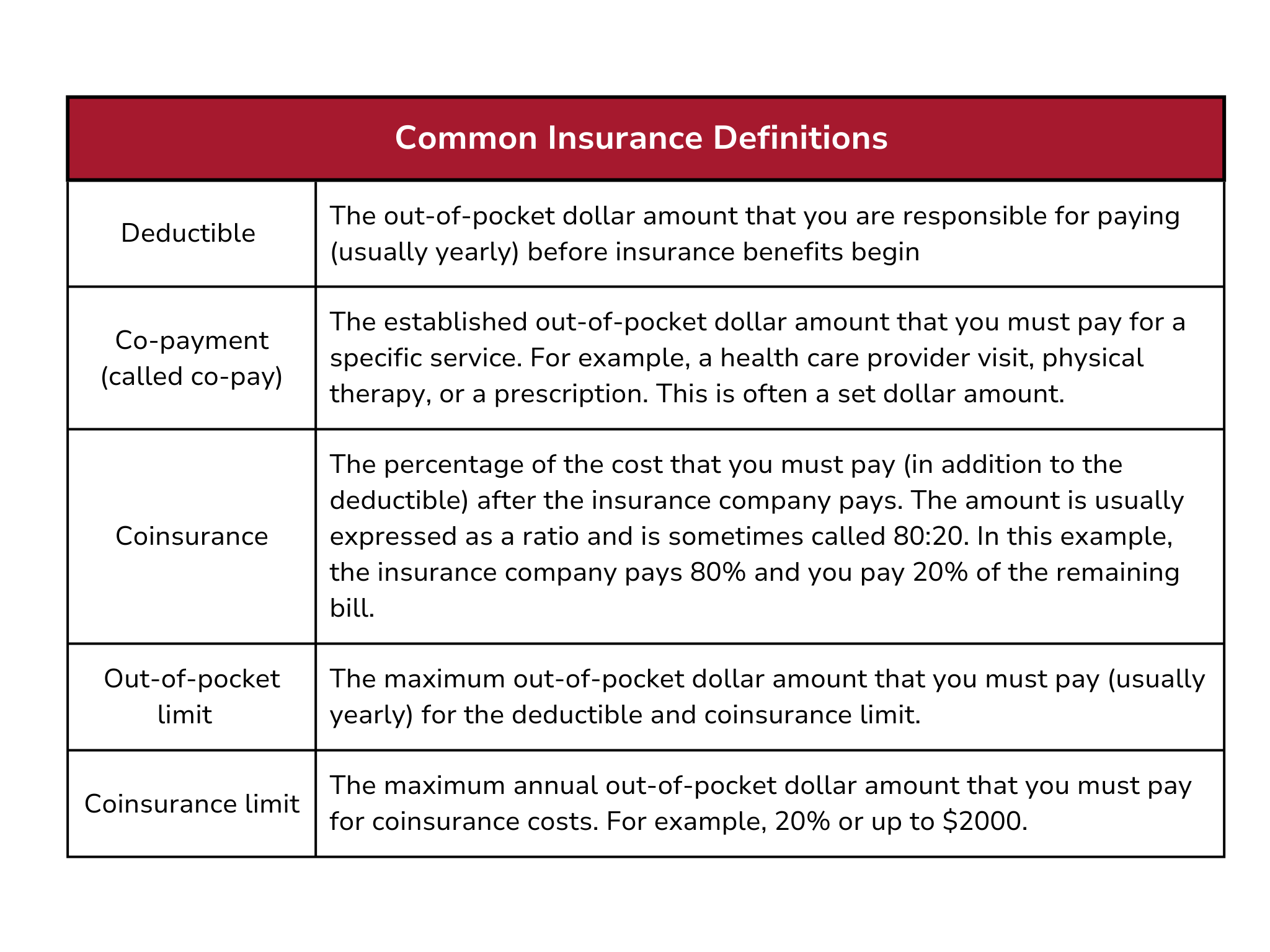

There are many complicated terms used by health insurance providers. Here are definitions of commonly used terms. These terms describe expenses that you pay, also called “out-of-pocket.” These terms are important to understand when trying to find a plan that works for you. These are the amounts (either in dollars or percentage of the cost) that are not covered by insurance that the enrollee in an insurance plan must pay.

Health insurance payments work differently depending on the plan you have selected for your family. Generally, you pay a monthly premium to have coverage. Some plans also have a deductible, which is the amount you must pay before the insurance starts covering the costs. Other plans may require you to pay a copayment, which is a fixed amount you pay each time you receive medical care.

To explore additional health care terms please visit NBDF’s Personal Health Insurance Toolkit HealthPlan Glossary.

How to Get Health Insurance

There are different ways to get health insurance. You can get it through your employer if they offer it as a benefit. You can also purchase it in Health Insurance Marketplace, directly from an insurance company, or through a government program such as Medicaid or Medicare. To learn more about the different types of insurance please go to Health Insurance: Options and Types.

To learn more about health insurance please go to NBDF's Personal Health Insurance Toolkit.

- Moseley, George. “The U.S. Health Care Non-System, 1908-2008.” AMA Journal of Ethics, vol. 10, no. 5, 2019, pp. 324–331, journalofethics.ama-assn.org/article/us-health-care-non-system-1908-2008/2008-05, https://doi.org/10.1001/virtualmentor.2008.10.5.mhst1-0805.. Accessed 15 Mar. 2023.